In July 2023 the Financial Conduct Authority’s new Consumer Duty comes into force, setting higher and clearer standards of consumer protection across the financial services sector. We take a closer look at what it means for the insurance industry.

What is the new Consumer Duty?

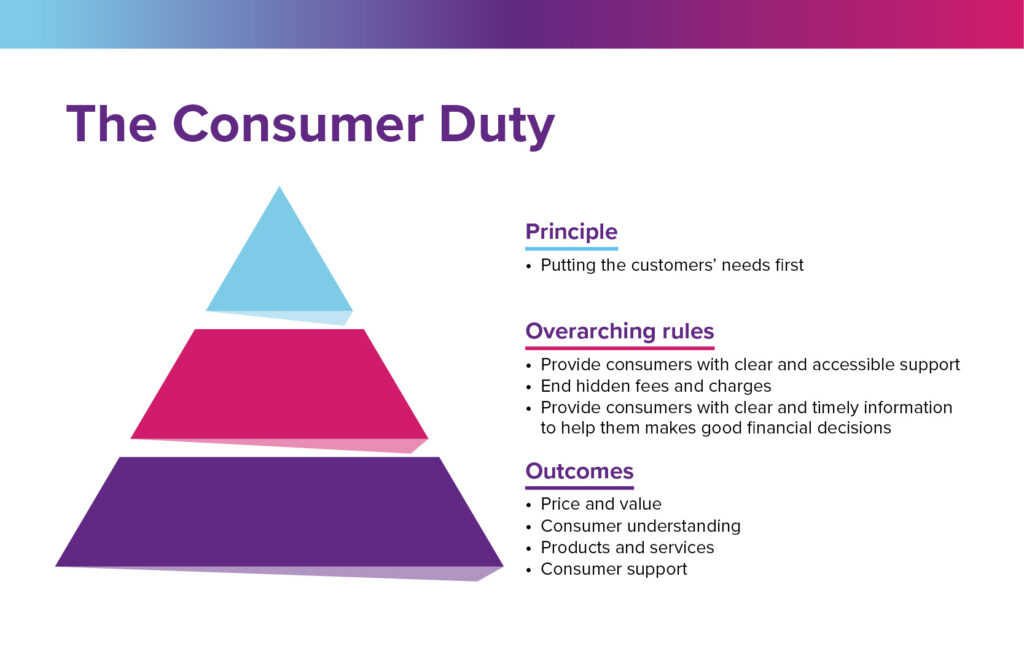

The Duty is a new set of overarching principles and new rules which financial services companies will have to follow, with a focus on “putting their customers’ needs first”.

It outlines four key outcomes against which firms should be judging their impact on consumers:

- Price and value

- Consumer understanding

- Products and services

- Consumer support

Under the new rules firms will need to:

- End hidden charges and fees

- Make it as easy to switch or cancel products as it was to take them out

- Provide clear and accessible consumer support

- Provide clear and timely information about products and services to help people make good financial decisions – no burying details in lengthy terms and conditions

- Provide products and services that are right for their customers

- Focus on the “real and diverse needs of their customers”, including those who are vulnerable, at every stage and in each interaction

Why has it been introduced?

The industry watchdog has concerns that some firms are presenting information in such a way that it makes it hard for customers to make timely and informed decisions, selling them products and services that aren’t right for them or providing poor customer support. In the current economic climate, it’s even more important that customers are give the help they need to make good financial decisions that result in good outcomes for them.

When does it come into force?

From the end of July 2023, the duty will apply to all new and existing products and services. From July 2024, the duty will be extended to also apply to closed products and services.

Who does the duty apply to?

All parties who can determine or influence customer outcomes need to be following the customer duty, from those designing products to those providing customer service and support, and every step in between. For the insurance sector this includes brokers as well as insurers.

Who are ‘consumers’?

The duty refers to ‘consumers’, but this doesn’t just mean individuals. The FCA has stated that ‘retail clients’ typically includes all clients apart from large corporate entities and government bodies – so it would cover SMEs, for example.

From an insurance perspective, the scope will follow ICOBS, meaning it doesn’t apply to reinsurance, contracts of large risk sold to commercial customers or other contracts of large risk where the risk is located outside the UK.

What does it mean for the insurance industry?

Like all areas of financial services, the insurance industry will need to take steps to ensure it is complying with the new duty, including everyone from insurers to brokers.

What does ‘good’ and ‘bad’ practice look like?

The FCA has issued a number of case studies highlighting good and bad practices. For the insurance industry, ‘bad practice’ could be having a complex claims process which deters many customers from pursuing claims, for example, including a requirement for customers to provide hard copies of all evidence.

On the other hand, ‘good practice’ would be drafting product content, where possible, to support the understanding of customers with low literacy or low numeracy skills involving financial concepts.

What support is available to financial firms?

The Chartered Insurance Institute has published a best practice guide to Consumer Duty

The FCA has a number of resources available to help support and inform firms, including handbooks and podcasts